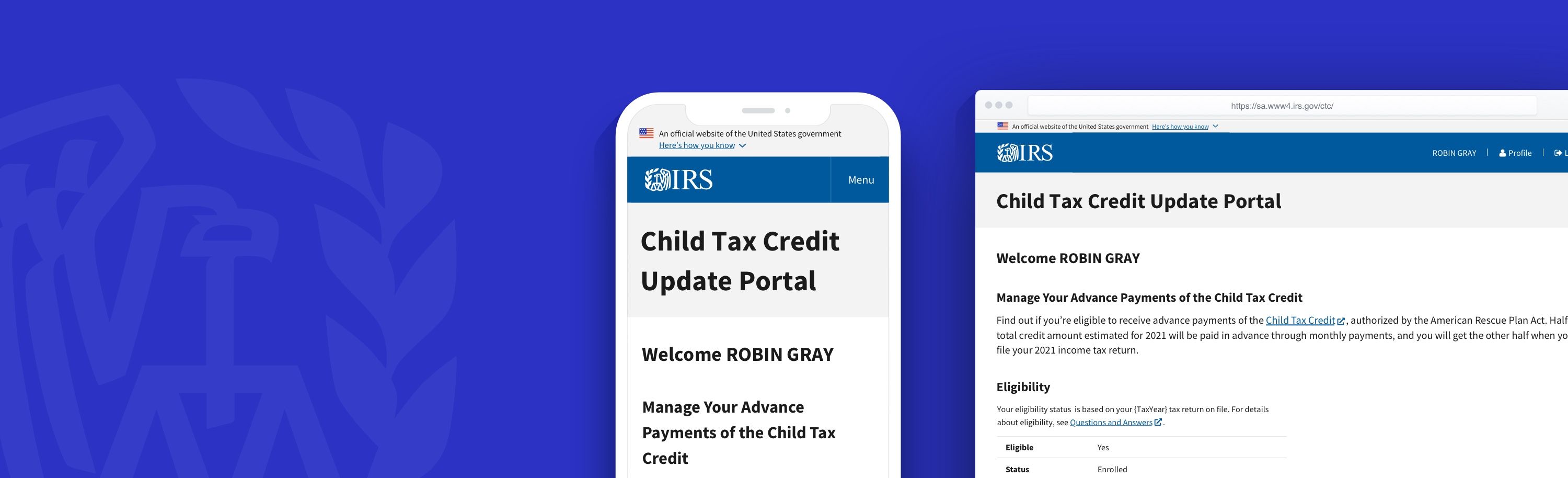

The IRS Child Tax Credit Update Portal is an online application serving over 30 million American households. Taxpayers use the portal to check eligibility, manage enrollment and see a history of payments received.

The Team

Under the management of OLS (IRS Office of Online Services), the CTC (Child Tax Credit) product team was composed of a few designers, developers, 508 specialists, a project lead, business analysts, a product manager, and the product owners.

My Role

As a consultant to the federal government, I served as Lead UX Designer for developing the complete user experience of the Child Tax Credit Update Portal application.

Lean UX

Due to the urgent and time-sensitive nature of this project we followed a fast-paced, bare-bones project delivery schedule.

The Challenge

In March of 2021, Congress passed new legislation that would expand the American Rescue Plan Act giving families who qualify additional tax benefits and credits. It would also direct the Treasury to issue half of these credits to families in advance of next year’s tax filing season. The IRS needed an online solution that would give taxpayers the ability to:

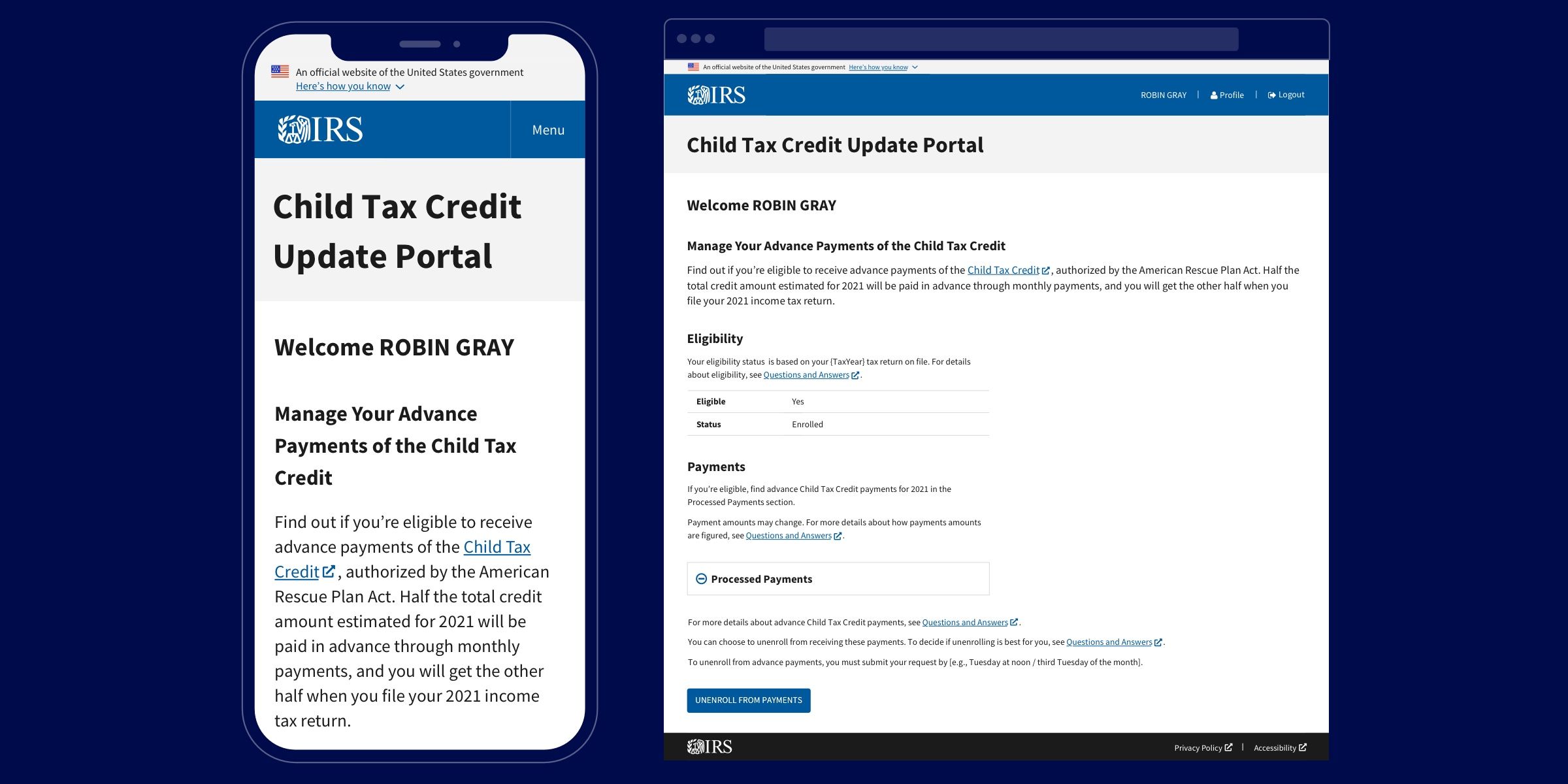

- Check eligibility status

- Manage enrollment with the program

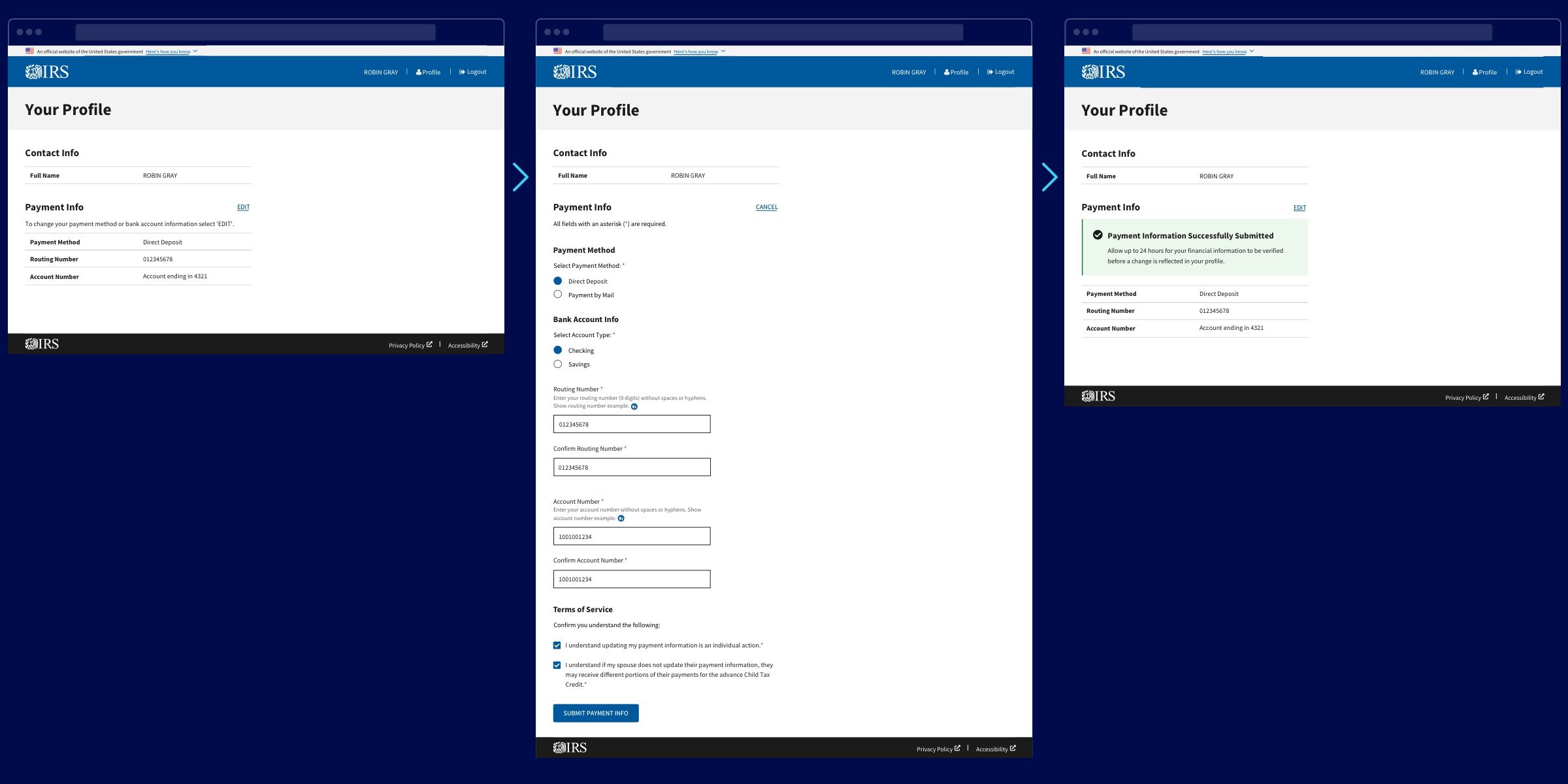

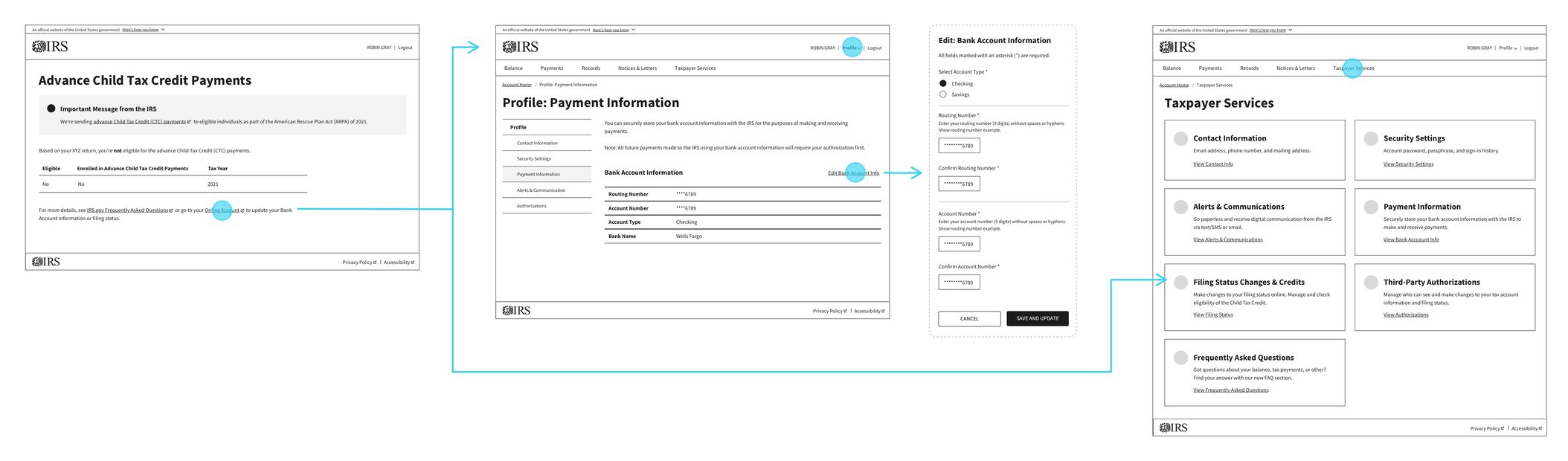

- Manage filing status and bank account information

- See a history of payments they received from the IRS

Our team had less than 3 months to fully elaborate, design and implement a production-ready solution that would reach nearly 30 million American households.

I was brought on to the team to help lead further design efforts a few weeks after initial elaboration was conducted and base user flows were created (by another designer).

Ideation

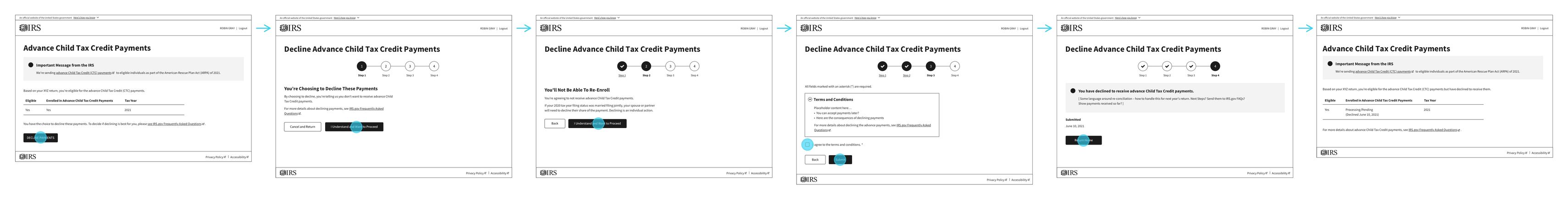

I created dozens of low-fidelity wireframes that addressed the highest risks identified by the business and product team. The following scenarios were given MVP-status priority:

- Eligible taxpayers

- Taxpayers who qualify are auto-enrolled in receiving advance payments from The IRS.

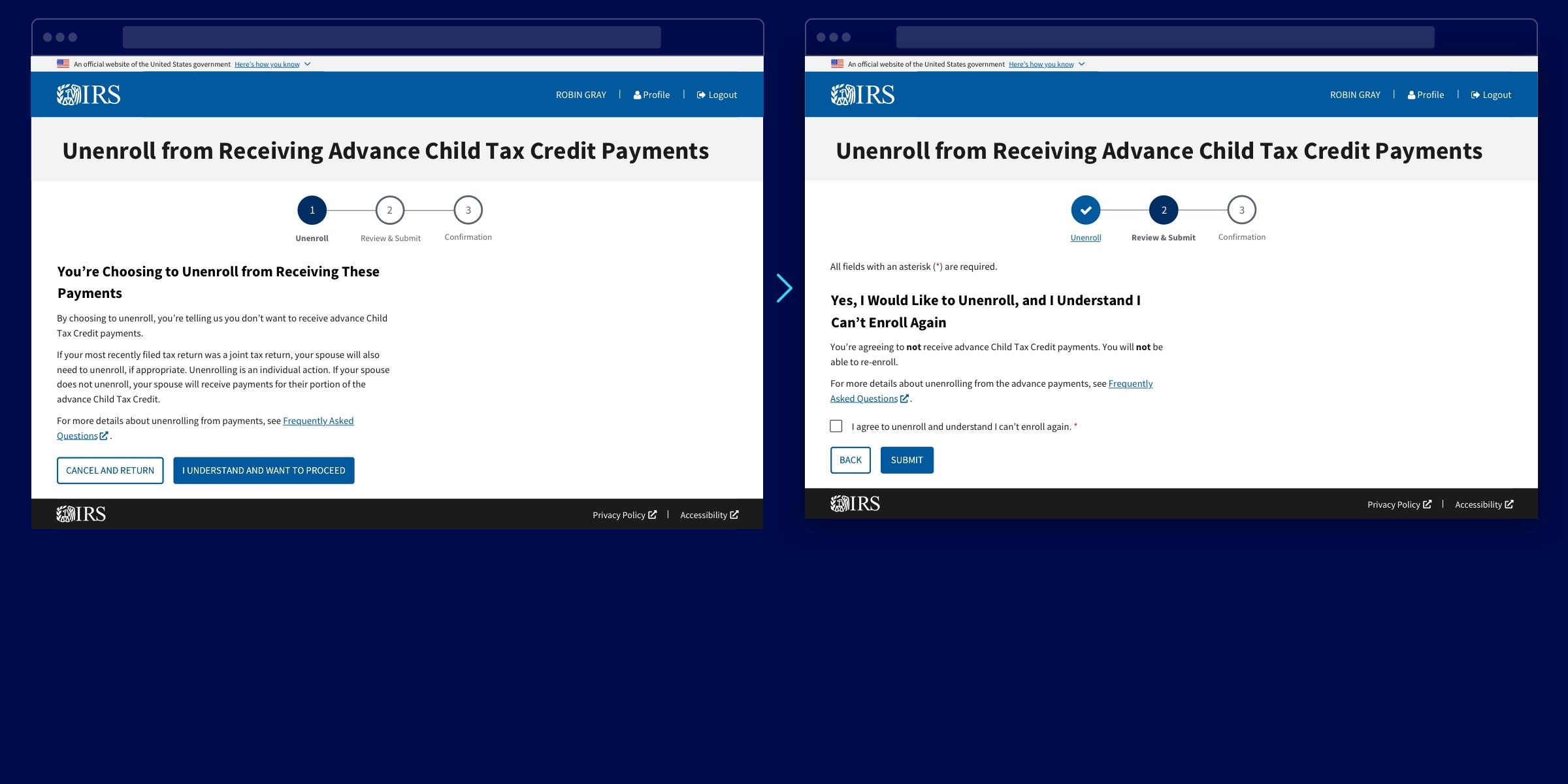

- Taxpayers who are auto-enrolled need the ability to opt-out or disenroll from receiving advance payments.

Scroll to view all. These wireflows illustrate how eligble taxpayers can unenroll from receiving advance payments.

- Non-eligible taxpayers

- Taxpayers who do not qualify are not auto-enrolled and will not receive advance payments from the IRS.

- Taxpayers who do not qualify may need to update their filing status or bank account information in order to become eligible.

Scroll to view all. These wireflows illustrate how non-eligble taxpayers will see an unenrolled status with the ability to navigate to Online Account to add/edit Bank Account info or update filing status.

Agile Design in Record Time

It's important to note that the final solution was not arrived at with a holistic HCD perspective or following our standard UX process. The necessity to divide the solution up into manageable chunks (from least to greatest risk) and hand these off to developers on a weekly cadence was of utmost importance.

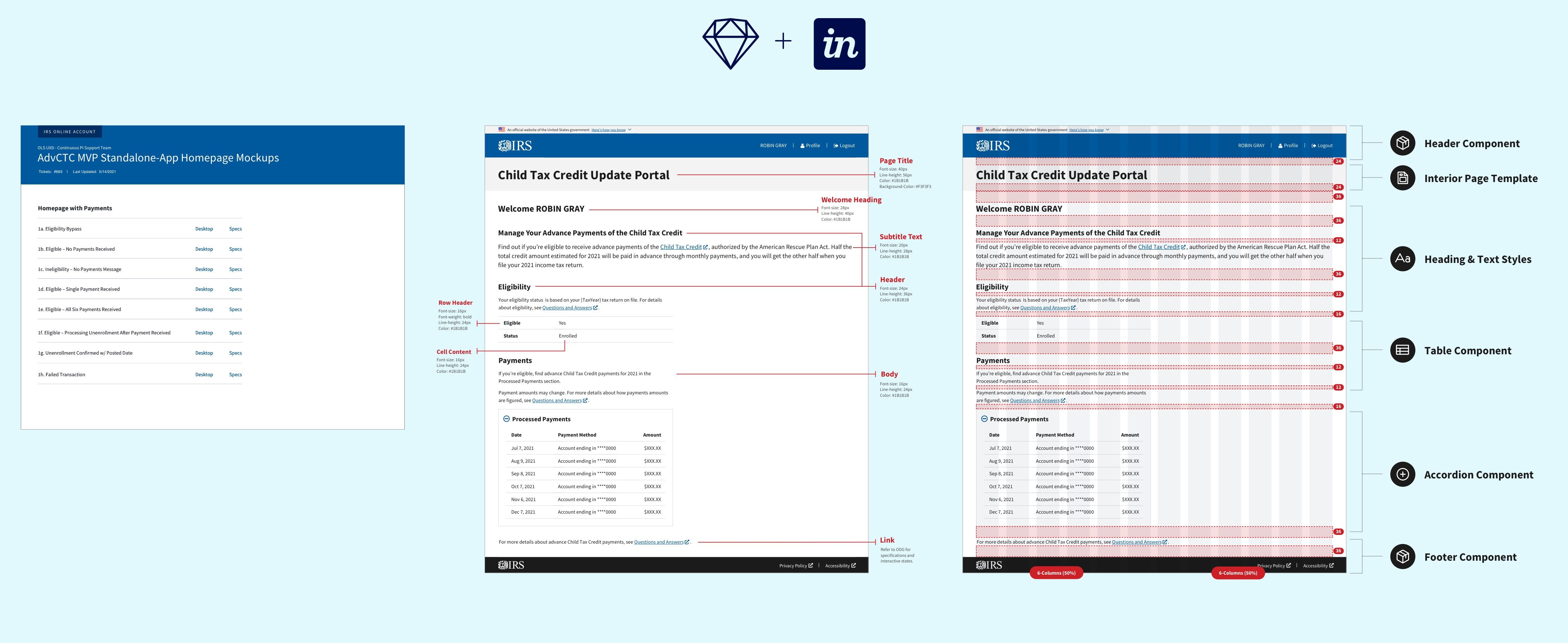

Mockups, Prototyping, & Specs

Having much experience and involvement with developing the IRS Online Design system, I was able to quickly apply the 508-approved patterns and components ensuring a rapid review and approval process with our accessibility team.

I created interactive prototypes using Sketch + InVision and provided developers with detailed specifications to communicate additional design guidance for things like spacing, padding, template layouts, and more.

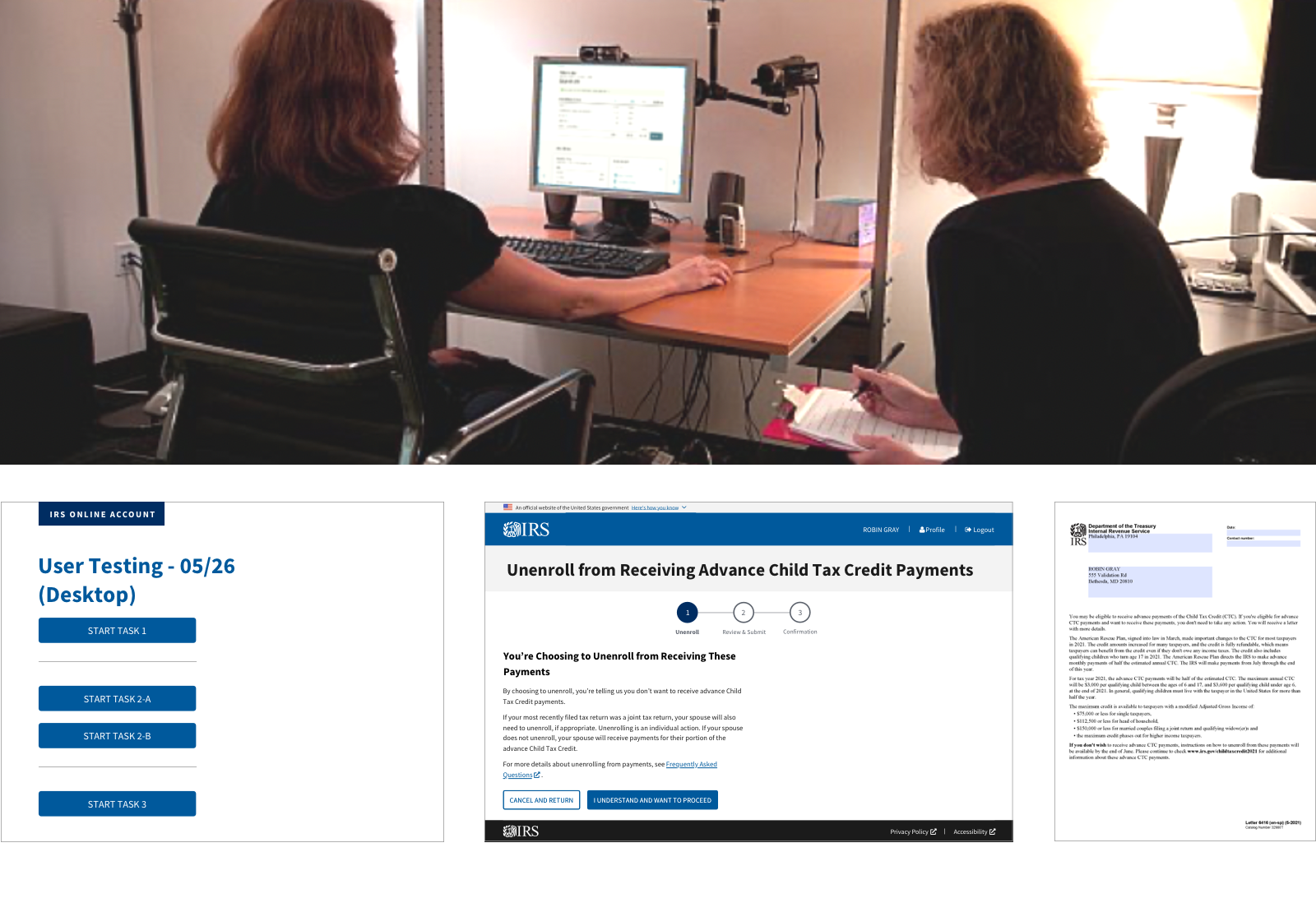

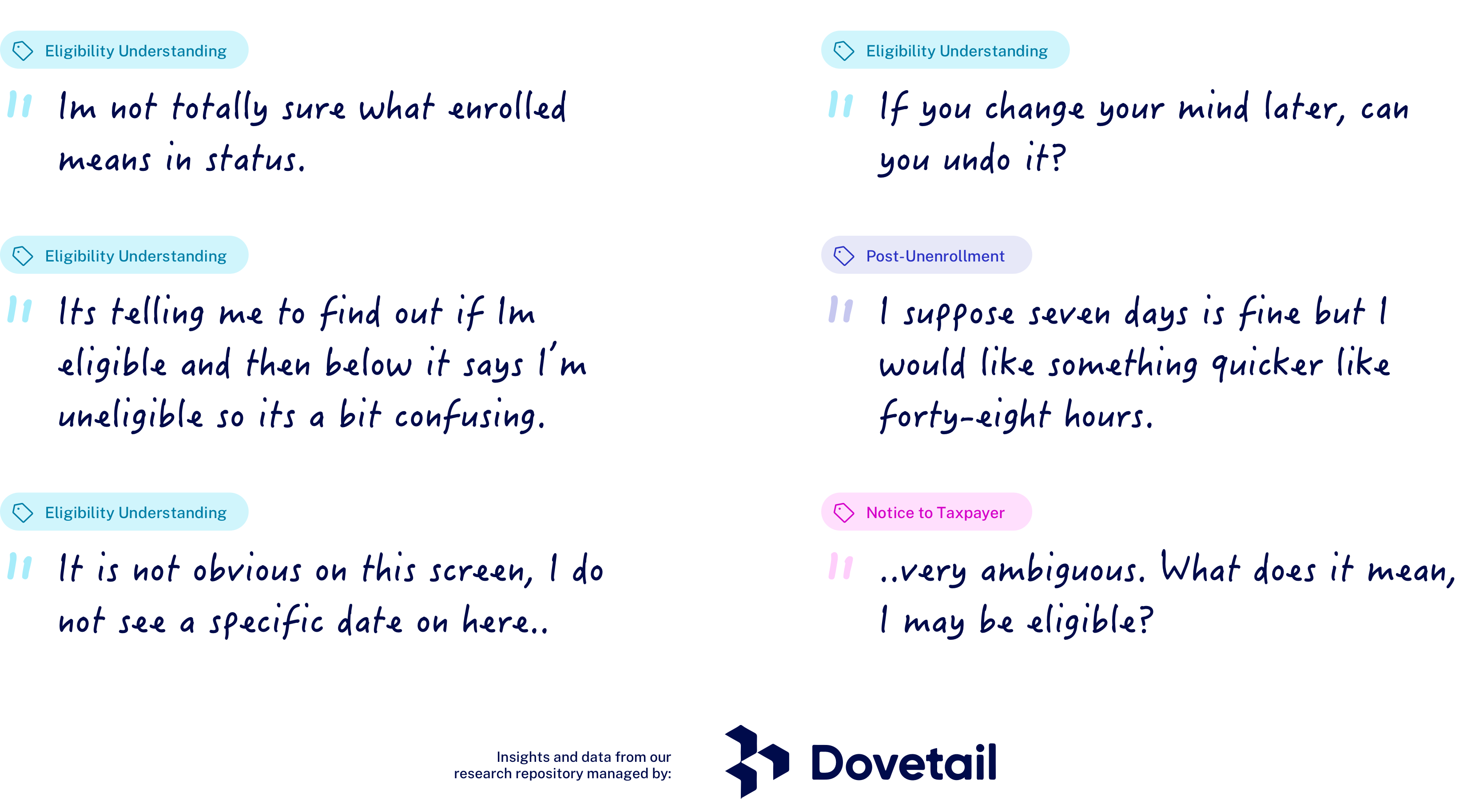

User Testing

We conducted a lightning round of user testing before handing off the MVP solution to developers. Twelve individuals with children ages 6-17 were recruited. We included a few scenarios and tasks where participants were both eligible and ineligible.

I was responsible for creating the UT interaction model (a.k.a testing prototype). I also worked with the research team in developing the learning objectives, recruitment criteria, as well as provided feedback on the moderator's guide.

Most issues discovered during user testing were related to the messaging and content presented to the participants. We needed to be even more clear about the taxpayers eligibility status and what the ACTC enrollment was informing them.

Deployment

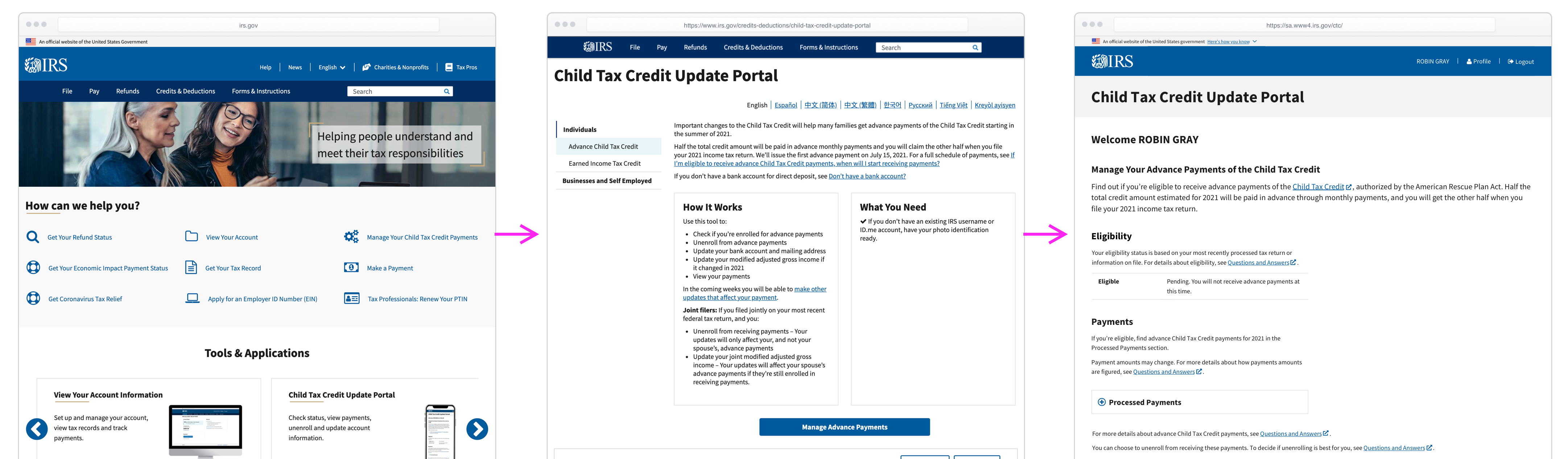

The MVP release of the application rolled out to the public in late June of 2021 with the first advance payment to eligible taxpayers being issued on July 15th.

I was responsible for the overall design of the portal application but also coordinated with the IRS.gov product team in implementing the public landing page and navigation.

Final Solution

(No caption available)

Recap of My Contributions

- Helped advocate for a lean-ux approach which allowed us to deliver designs early, often, and in record-breaking time

- Created wireframes, mockups, and prototypes

- Created a user testing model and coordinated closely with the research team in developing test objectives, recruitment screening, and the moderator’s guide

- Created detailed design specifications that were handed off to developers

Lessons Learned

- Expect business requirements to change frequently and decisions to pivot often (especially with government).

- Stay calm, do your best, keep a positive attitude, and don't panic.